st louis county personal property tax on car

Personal property taxes are based on where you live and what you own on January 1 and accounts do not transfer across jurisdictions. Search by Account Number or Address.

City Clears Blankets Clothes From Downtown St Louis Homeless Downtown City Homeless

You are in an active bankruptcy Form 4491.

. Louis County Circuit Court 7900 Carondelet in Clayton Monday through Friday 800 am to 500 pm. To declare your personal property declare online by April 1st or download the printable forms. St Louis County Ecc.

Louis County residents and the county is encouraging people to avoid the line and pay online. You moved to Missouri from out-of-state. It is your responsibility to establish and close accounts as you move across jurisdictions.

Every person owning or holding real property or tangible personal property on the first day of January including all such property purchased on that day shall be liable for taxes thereon during the. Often that means a vehicle like your car or truck. This is your first vehicle.

You may file a Small Claims case in the St. To view past reports select Include Archived Items. The Assessment lists are mailed by the Assessors Office in January of each year.

The median property tax on a 17930000 house is 224125 in St. For information call 314-615-8091. Online declarations are available no later than the last day of January through April 1 of.

Leave this field blank. Louis County The median property tax on a 17930000 house is 163163 in Missouri The median property tax on a 17930000 house is 188265 in the United States. Taxes are imposed on the assessed value.

Louis County Encourages Residents to Pay Personal Property Real Estate Taxes Online. Louis collectors office sent you receipts when you paid your personal property taxes. Personal property account numbers begin with the letter I like in Individual followed by numbers.

Louis personal property tax history print a tax receipt andor proceed to payment. If April 1st is a Saturday or Sunday then the due date will be. Personal property taxes are usually assessed as a percentage of the value of an item.

How is personal property tax calculated in St Louis County. You can also obtain a receipt for 100 at one of our offices. Your county or the city of St.

You may be entitled to a personal property tax waiver if you were not required to pay personal property taxes in the previous years. You must present the receipts an original photocopy fax copy or copy of an internet confirmation screen is acceptable when you obtain license plates. Louis County Revenue Department collects taxes on both real estate and personal property such as cars and recreational vehicles.

Personal property taxes are levied annually against tangible personal property and due upon receipt of the tax bill but no later than December 31 each year. The good news is that tax can be claimed when you file. The Missouri Department of Revenue requires proof of paid personal property taxes or a waiver.

Collector of Revenue FAQs. Obtain a Personal Property Tax Receipt Instructions for how to find City of St. All City of St.

Vehicle values are based on the average trade-in value as published by the National Automobile Dealers Association RSMo 137115. The Personal Property Department collects taxes on all motorized vehicles boats recreational vehicles and motorcycles. The leasing company will be billed for personal property tax directly.

The assessment is made as of January 1 for the current years tax and is predicated on 33 13 of true value. Use this calculator to estimate the amount of tax you will pay when you title your motor vehicle trailer all-terrain vehicle ATV boat or outboard motor unit and obtain local option use tax information. Declare Your Personal Property Declare your personal property online by mail or in person by April 1st and avoid a 10 assessment penalty.

See reviews photos directions phone numbers and more for St Louis County Personal Property Tax Office locations in Hazelwood MO. Saint Louis MO 63105. Paid Personal Property Tax Receipts.

LOUIS COUNTY MO November 10 2021 - Personal Property and Real Estate tax bills for 2021 will soon arrive is mailboxes for St. County Parish Government. Residents can pay their Personal Property.

In some states personal property tax refers to mostly household personal property items. Declarations are due by April 1st of every year. The Property Tax Reports give detailed information to help determine your property tax amounts.

168 N Meramec Ave. If you opt to visit in person please schedule an appointment. Even if the property is not being used the property is in service when it is ready and available for its specific use.

If you have any questions you can contact the Collector of Revenue by calling 314 622-4105 or emailing propertytaxdeptstlouis-mogov. State Tax Commission 437 SW2d 665 668 Mo. For a pamphlet with information on Small Claims Court call 314-615-2601 or 314-615-2592.

The reports are shown in the table below. Per Missouri Revised Statute 137122 property is placed in service when it is ready and available for a specific use whether in a business activity an income-producing activity a tax-exempt activity or a personal activity. Saint Louis County Personal Property Tax.

You pay tax on the sale price of the unit less any trade-in or rebate. State Muni Services. They can fall under county or state taxes depending on where you live.

Your feedback was not sent. Louis taxpayers with tangible property are mandated by State law to file a list of all taxable tangible personal property by April 1st of each year with the Assessors Office. Louis County Courthouse 100 North 5th Avenue West Duluth MN 55802.

Personal property is assessed at 33 and one-third percent one third of its value. County Parish Government Government Offices Federal Government. If you have questions about whether your vehicle was taxed or the value please contact the Leasing Section at 314-615-5102.

Assessing Personal Property Tax.

7 Reasons Why Every Homebuyer Needs Owner S Title Insurance Title Insurance Insurance Marketing Title

Debaliviere Strip Looking North In The Early 1970 S Part Of The Strip Was Destroyed By Fire In 1976 And The Rest Was Architecture History St Louis Historical

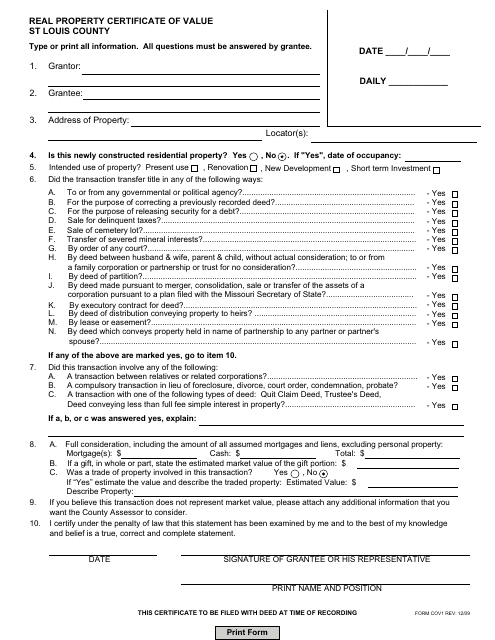

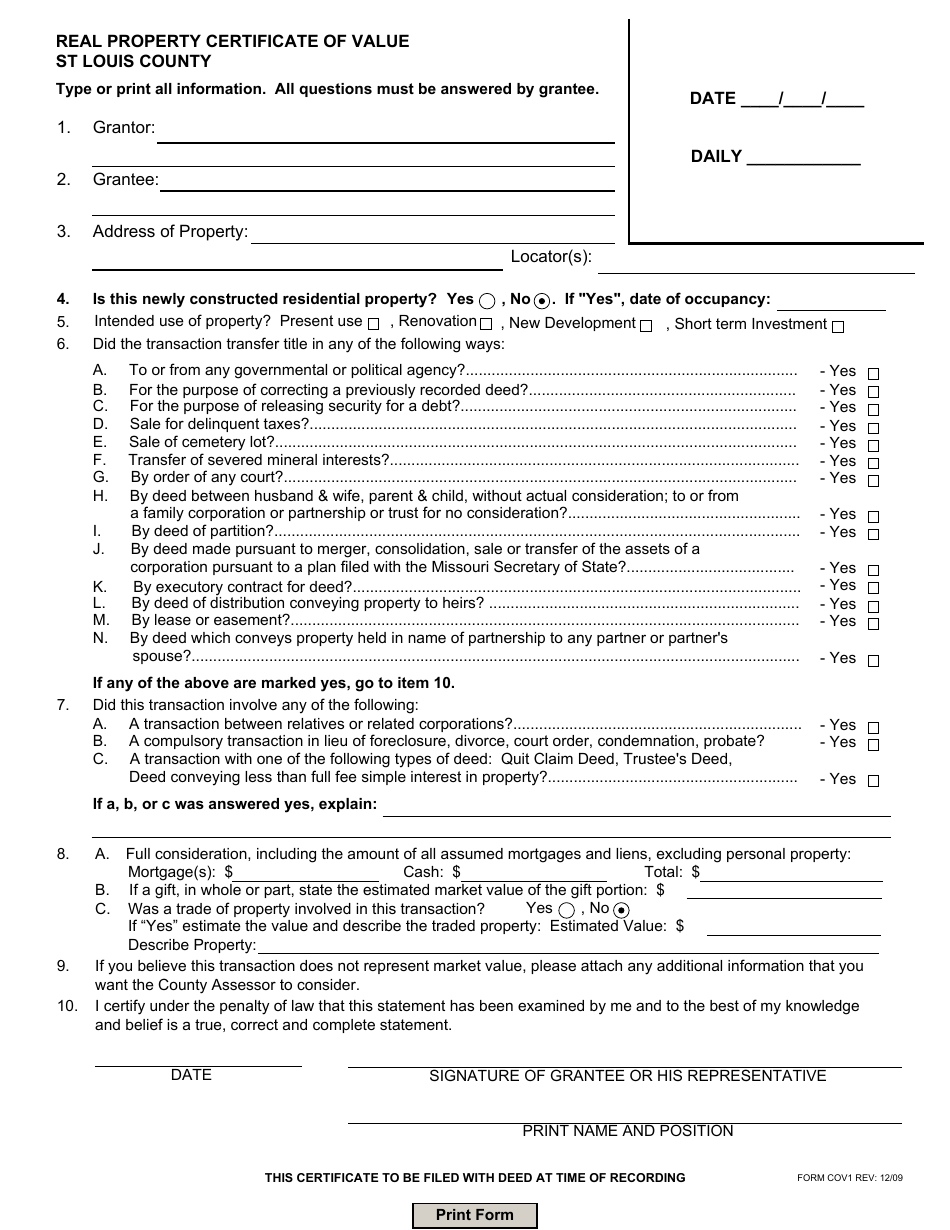

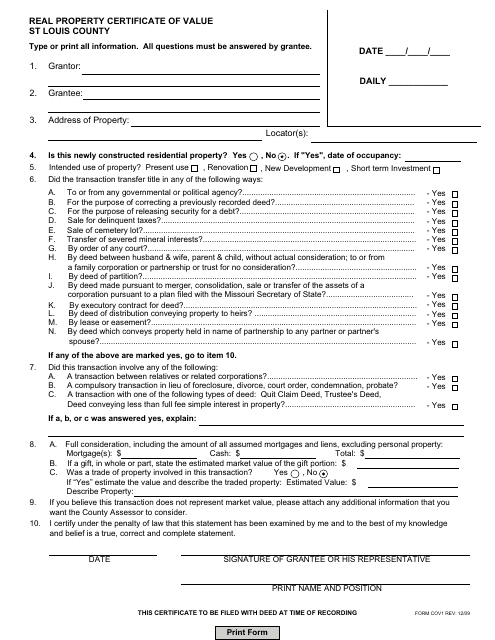

Form Cov1 Download Fillable Pdf Or Fill Online Real Property Certificate Of Value St Louis County Missouri Templateroller

Action Plan For Walking And Biking St Louis County Website

Grand Theatre In St Louis Mo Cinema Treasures St Louis County St Louis Mo St Louis Missouri

County Assessor St Louis County Website

Services St Louis County Website

St Louis County Explains Delays In Mailing Personal Property Tax Ksdk Com

Online Payments And Forms St Louis County Website

![]()

Action Plan For Walking And Biking St Louis County Website

Print Tax Receipts St Louis County Website

4 Insurance Types Offered Auto Insurance Homeowners Insurance Renters Insurance Health Insurance In Car Insurance Homeowners Insurance Best Insurance

Collector Of Revenue Faqs St Louis County Website

Form Cov1 Download Fillable Pdf Or Fill Online Real Property Certificate Of Value St Louis County Missouri Templateroller

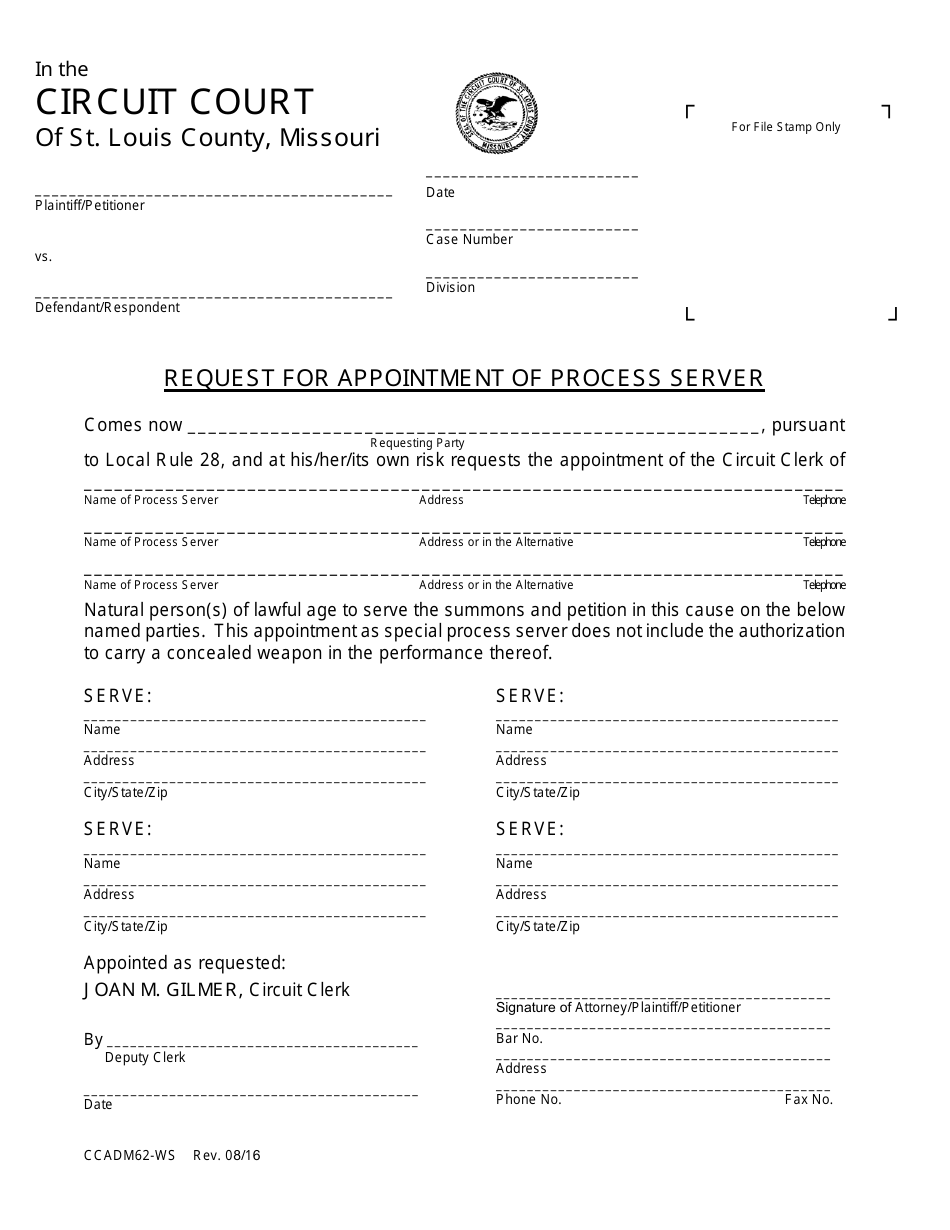

Form Ccadm62 Ws Download Fillable Pdf Or Fill Online Request For Appointment Of Process Server St Louis County Missouri Templateroller