capital gains tax indonesia

Taking a look at the capital gains tax rates in Indonesia compared to other countries in the Asia. For example a higher rate taxpayer making a net gain of 100000 on a second home would pay 24556 in CGT.

Income Tax Capital Gains Part 1 Charging Section And Transfer Income Tax Act 1961 Youtube

An individual is an Indonesian tax resident where the individual resides in Indonesia is present in Indonesia for 183 days or more in any 12-month.

. Proceeds from sale of shares on Indonesian stock. Under a trade and asset sale the gain on sale proceeds including any capital gain is taxed as part of normal income at the corporate income tax rate of 22. Capital gains on the sale of shares listed on the indonesian stock market.

In Indonesia the main differences among acquisitions made through a share deal versus an asset deal are as follows. The normal rate of corporate income tax is 25. Di tahun 2015 capital gain jangka panjang dikenakan pajak yang bermacam-macam mulai dari 0 untuk pajak penghasilan 10 dan 15 15 untuk pajak penghasilan.

Capital gains taxes. On the transfer of assets other than land and buildings 25 capital gain tax due on net basis will apply for the Indonesian tax resident seller. However gains from the transfer of land.

Indonesia introduced a 01 VAT and capital gains tax on crypto transactions and investments. 151 rows Capital gains from the sale of real estate are subject to a separately assessed real. However there are.

The taxes will come into effect from May 1. NRI Advisory Services provides Income Tax Return in Indonesia with an excellent reputation for delivering world class services If you are searching for Capital Gains Tax Indonesia then. Share deal Capital gains received by an entity in a share deal are subject.

Taxes on crypto have been facing. Capital gains are generally assessable together with ordinary income and subject to tax at the standard CIT rate. The settlement and reporting of the tax due is.

Capital gains tax rate 01-35 Residence. 5 rows In general a corporate income tax rate of 25 percent applies in Indonesia. In general a corporate income tax rate of 25 percent applies in indonesia.

Capital gains tax CGT is levied on the rise in value of an asset. Interest on bonds other than that payable to banks operating in Indonesia and government-approved pension funds. 15 hours agoAs per the report the panel proposed a long-term capital gains LTCG tax of 10 per cent on profits from the sale of equity assets that are held for more than a year.

Individuals paid capital gains tax at their highest marginal rate of income tax 0 10 20 or 40 in the tax year 20078 but from 6 April 1998 were able to claim a taper relief which. Capital gains are subject to the normal CIT rate except for certain tax objects subject to final income tax see the Withholding taxes section. The tax rate is 20 for limited liability companies where at least 40 of their shares are traded on the Indonesian stock.

In arriving at effective capital gains tax rates the Global Property Guide makes the following.

Taxing The Rich The Evolution Of America S Marginal Income Tax Rate Infographic

Top 8 Things To Know About Taxes For Expats In Indonesia

Deutsche Bank Automates Post Trade Tax Processes In Indonesia

Capital Gains Tax In Indonesia Things You Need To Know

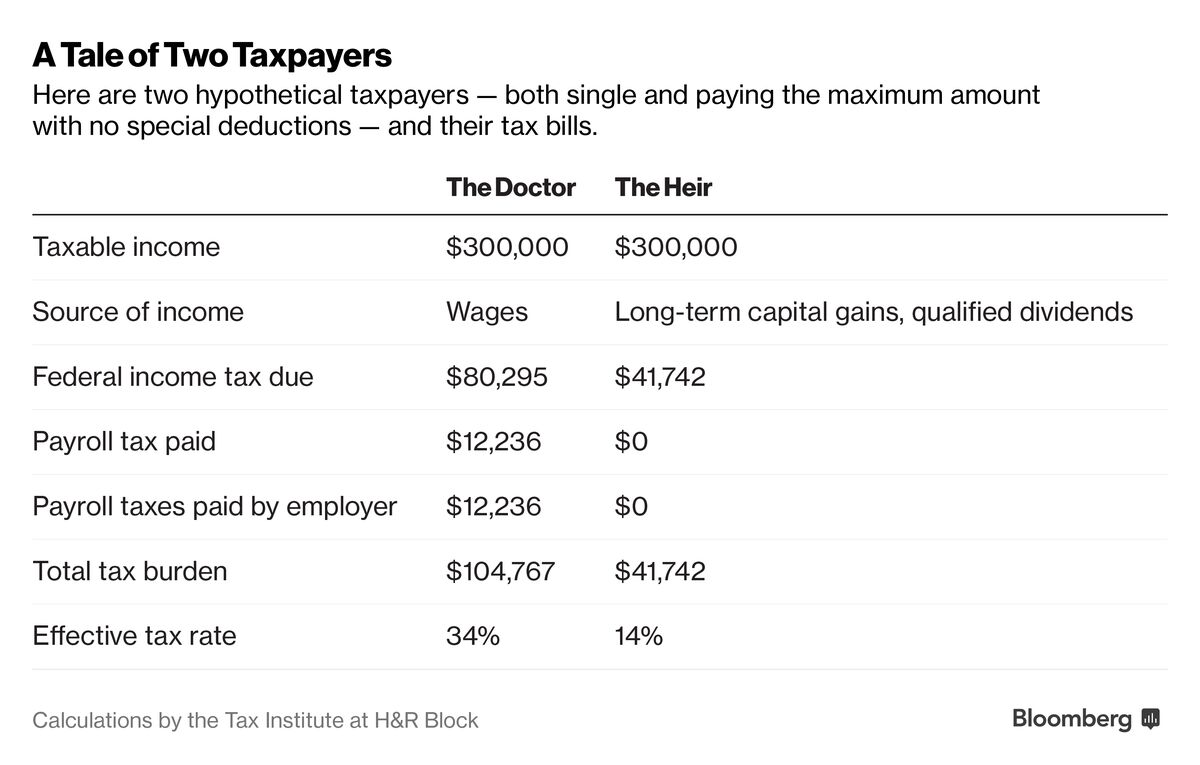

Why American Workers Pay Twice As Much In Taxes As Wealthy Investors Bloomberg

Top Rates For Income Tax Source Indonesia Government 2008 Download Scientific Diagram

Ace Newsletter Capital Gains Tax In Kenya And Other Tax Updates

Indonesia To Impose Vat Income Tax On Crypto Assets From May Reuters

How Indonesia Can Rev Up Its Faltering Economic Growth Carnegie Endowment For International Peace

Opportunity Fund American Group

Why Indonesia Should Raise The Income Tax Of The Ultra Rich Individuals

Capital Gains Tax In Indonesia Things You Need To Know

Starting May 1 Indonesia Will Impose A 0 1 Cryptocurrency Vat And Capital Gains Tax Coincu News

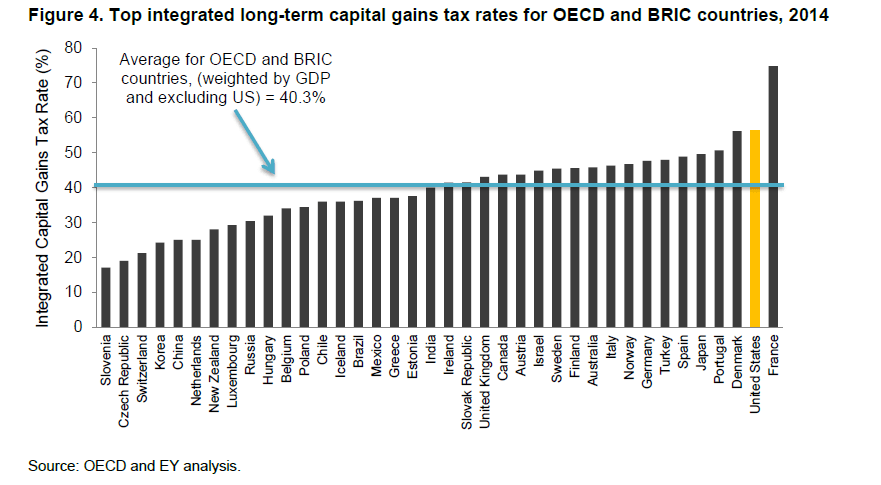

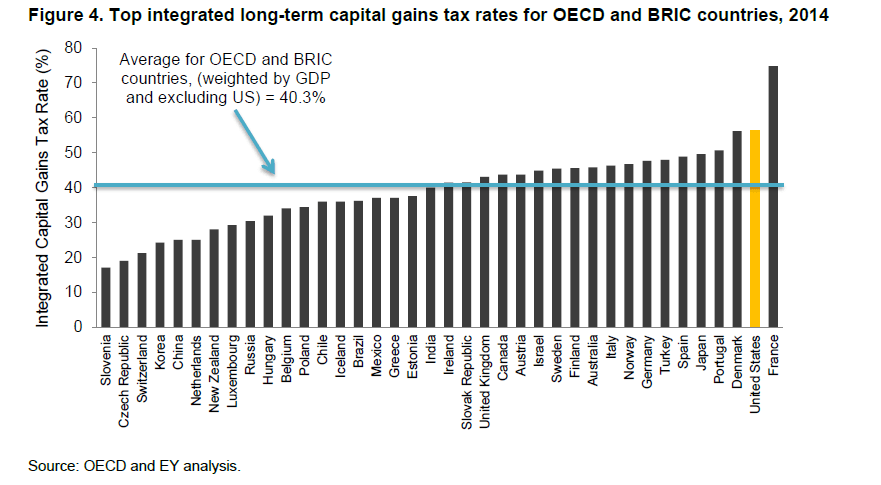

International Top Long Term Capital Gain Tax Rates Comparison Where Does The Us Stand Topforeignstocks Com

Marshall Islands Tax System Taxation Of Marshall Islands Companies And Individuals Vat Income Tax And Capital Gains Tax Treaties Of The Marshall Islands Gsl

Indonesia Set To Impose Income Tax On Crypto Assets From May Blockchain News

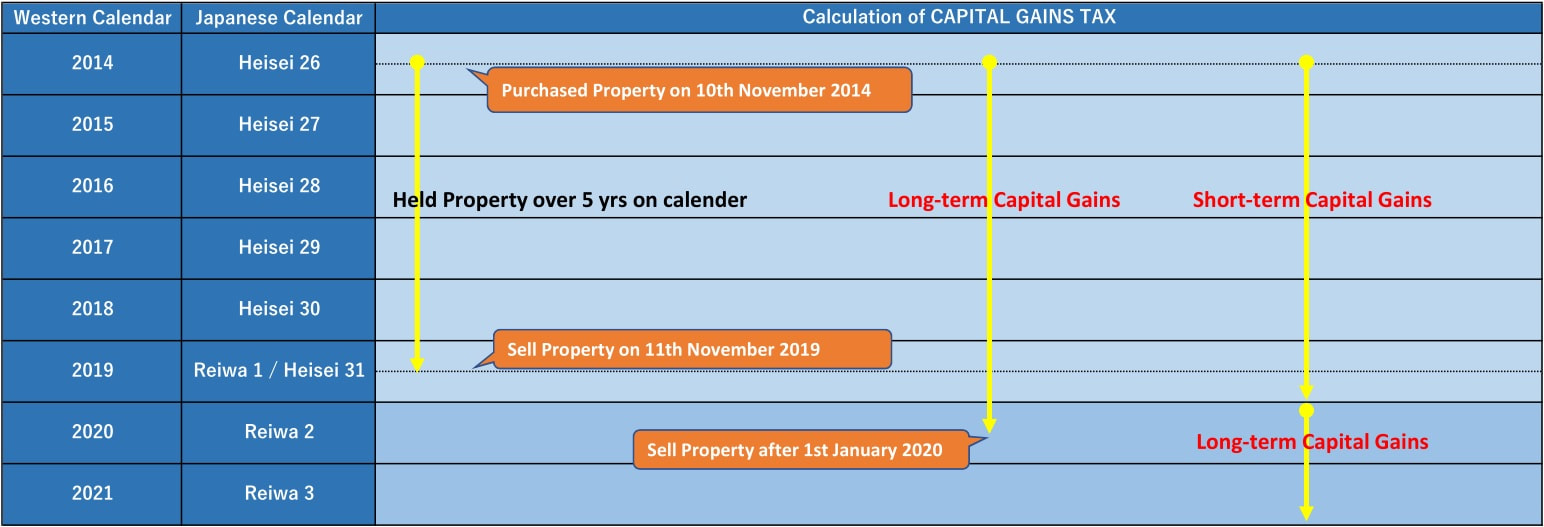

Capital Gain Tax Arrows International Realty

Taxation Of Investment Income Within A Corporation Manulife Investment Management